“Today we’re doing copper.”

It can be hard to keep up with Donald Trump’s intentions on import tariffs, but this was the off-the-cuff remark he made before a cabinet meeting earlier this week. His plans are to introduce a 50% import tax on copper entering the US from other countries. The effect of this announcement was immediate: copper prices surged to a record high in the US.

What does it all mean for the copper industry? In this blog, we attempt to lift the lid on the potential impact of copper tariffs should the imposition of a 50% rate on US imports come to pass.

Why does copper matter?

Copper is the main chemical element in most of the alloys we stock at Columbia Metals. Our trademark alloys alone demonstrate this clearly: Nibron Special® contains at least 80% copper, Coldur-A® comprises over 96% copper, and Colsibro® tops the rankings at 97%. We export our products globally, including to the United States, and we are therefore keeping a watchful eye on how the tariff situation involves.

Metal markets across the globe are also bracing for impact. While the tariff would be a direct hit on US importers, the ripple effects could shake pricing, trade flows and material availability throughout the EU and UK.

Copper and its alloys are used extensively in building construction, electrical grids, electronics, the medical sector and transportation.

A quick recap

Since taking office in January, US President Donald J Trump has taken swift and unprecedent action in adjusting the rules of international trade. His protectionist agenda, culminating in “Liberation Day” on 2 April 2025, is based on a view that tariffs will promote domestic manufacturing, protect national security and provide a substitute for income taxes.

For a globally traded commodity like copper, any tariffs would have widespread knock-on effects.

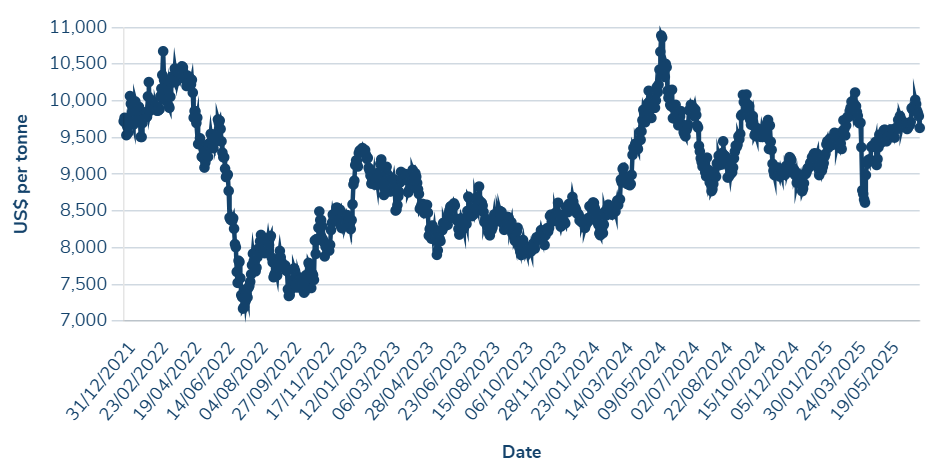

Copper prices have been steadily climbing since mid-2022, driven by growing demand for several emerging industries:

- Electrification and green infrastructure (EVs, wind, solar, grids)

- Data centre growth and AI infrastructure

- Renewed industrial output in Asia and Europe

Supply bottlenecks have also contributed to this trend. Global inventories are low and smelters have been struggling with rising energy and labour costs. The supply base is ageing and expensive. The quality of copper ore grades is declining, discoveries are rare and new mines can take over a decade to start active production.

What could happen if US copper tariffs are imposed?

We foresee three possible scenarios.

- Global price surge

A 50% US tariff would disrupt trade routes and pricing models. US buyers have already been acting to import copper ahead of schedule, and much of the metal is currently in warehouses or part of long-term financing agreements. This hoarding, coupled with the high cost of exporting from the US, could lead to a situation where a significant amount of global copper is stranded in the US and unavailable to the rest of the world.

It’s also likely that traders could drive prices even higher, affecting European and global markets. Stockholders with substantial stock levels would face the double-edged sword of seeing sharp gains in asset value alongside rising replacement costs. These costs may need to be passed down the supply chain to end users, leading to inflationary trends.

- Reversal of trade flows

It’s equally possible that copper and copper alloys destined for the US could be diverted to Europe, potentially increasing short-term supply on the continent. This could have a counterbalancing deflationary effect, with downward pressure on prices for certain grades or forms.

- Acceleration of substitution and recycling

Copper has been around for centuries and its excellent electrical and thermal conductivity make it ideal for wiring and plumbing. However, for some applications high prices and tariff uncertainty may push manufacturers to substitute copper with aluminium or composites where feasible. This has already been seen in overhead lines, heat exchangers, wiring in aircraft and composite piping in modern buildings.

Further to this, we could see a trend towards more recycling of copper. This would be particularly relevant in melting and reuse for semi-finished products such as the ones stocked by Columbia Metals. Global initiatives towards sustainability could play a role in this too: the International Copper Association (ICA) estimates that recycled copper has up to 85% lower carbon emissions than virgin mined copper.

The Columbia Metals crystal ball

So what will happen next? All we can say for sure is that the proposed US copper tariffs are not just an American problem, but one that will have consequences for the global copper supply chain. The landscape is shifting, and Columbia Metals will remain committed to maintaining high levels of stock in a wide range of sizes to keep the wheels of the supply chain turning.

The final word goes to the American maths professor John Allen Paulos: “uncertainty is the only certainty there is.”